Financial Matters

Back to Sales Staff Manual Content

<< Previous Article | Next Article >>

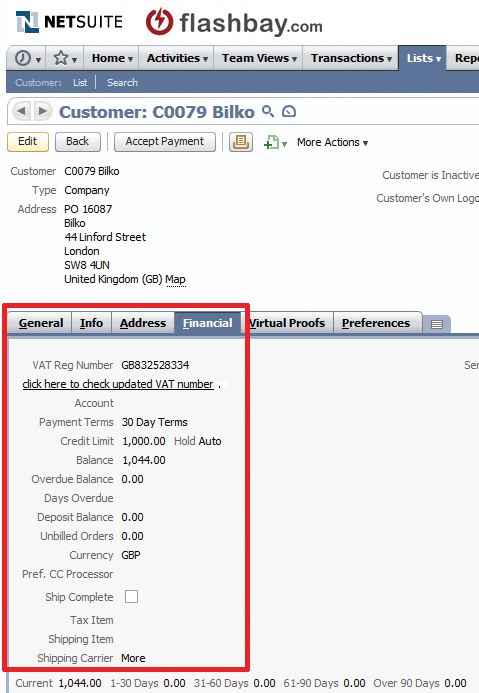

The Netsuite Financial Tab

There are some areas within the ‘Financial’ tab of a customer record that employees should familiarise themselves with. You can add/edit information of certain fields by clicking the ‘Edit’ button.

VAT Reg Number

This field is applicable to customers registered in the EU – if your customer provides a valid VAT number they will not be liable to pay UK VAT. This obviously does not apply to UK customers who will always be charged at 20%. It is important that VAT numbers are validated, otherwise Flashbay may be held accountable for payment when incorrect numbers are used. There is a simple procedure to validate VAT numbers:

Enter the VAT number then click the link which says ‘click here to check updated VAT number’ – if the number is valid it will show a green tick, and if invalid will show a red cross. Alternatively you can validate the VAT number via this link https://ec.europa.eu/taxation_customs/vies/#/vat-validation . This website is also useful if you need to check whether a VAT number is in the correct format.

Currency

By default, the currency of every new lead is set to the respective currency of the territory you primarily deal with. When you are scheduling an order for a first-time customer that is not being billed in the default currency, the correct currency must be selected and saved beforehand. The currency cannot be changed after the first order has been placed. Therefore it is suggested to set the currency you anticipate will be used when first viewing the lead.

Credit Applications and Payment Terms

By default all Flashbay customers are placed on Advanced Payment terms. Customers meeting our strict criteria may be offered Credit terms subject to approval as detailed below:

1. Advance Payment

New customers should always be placed on advance payment with the exception of certain classes of customers who can be considered for credit terms immediately, e.g. major companies or governmental institutions.

2. Credit terms

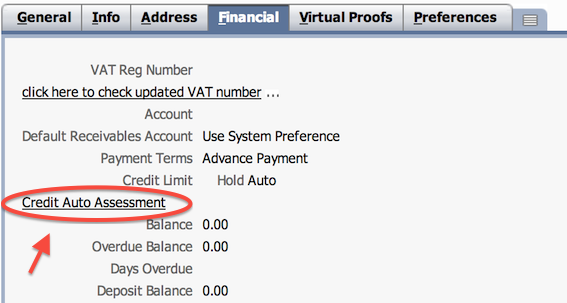

The Credit Auto Assessment Tool within Netsuite should initially be used on every occasion to assess the amount of credit Flashbay can offer.

Standard payment terms for credit terms are 30 days or less. Customers requests of payment terms longer than 30 days need to be double checked and approved by Accounts in every case; even if the requested credit limit is less than £10,000 or equivalent in other currrencies.

Credit request via text parts and Auto Assessment

- All customer records should already have the customer web address completed but if this has not been done enter it now:

Please ensure you have entered the correct web address, as in the example above the general BMW website (www.bmw.com) would alter the credit approval outcome.

In case of franchises or groups it's important to enter the real address for the actual business of the customer rather then the global address.

All credit requests are logged and overviewed to improve the decision making process.

- The Credit Auto Assessment tool can be found under the 'Financial' tab on customer records.

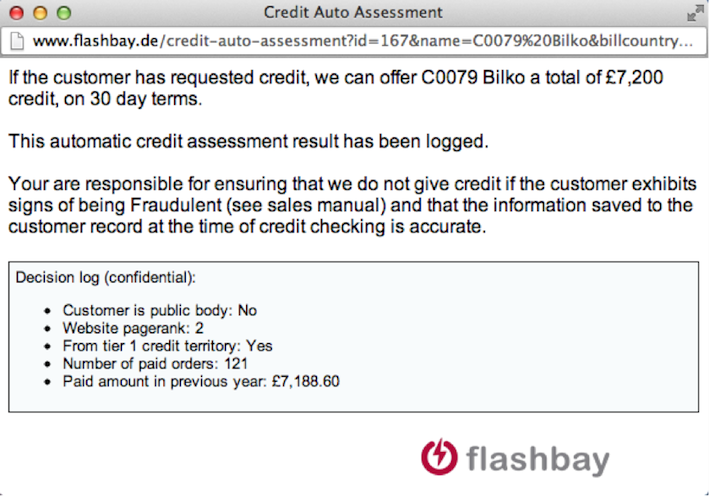

Clicking the 'Credit Auto Assessment' link will launch a small popup window containing the output of the tool.

Approved Credit:

If you receive approval for your credit request you can go ahead and enter the given credit terms into Netsuite:

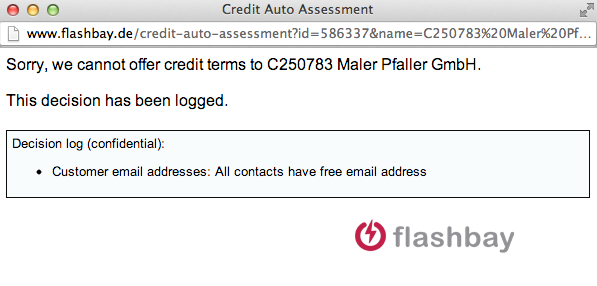

Declined Credit:

If the tool does not approve sufficient credit or any credit at all, Group Leader, Team Leader or Accounts shall be contacted as they can carefully analyse the creditworthiness of a customer and can override the tool's decision. Please contact by using the text appropriate text parts

- New Email -> Text Parts -> Credit requests ->

Group Leaders for credit requests up to £5,000

Team Leader for credit requests between £5,000 and £10,000

Accounts Department for credit requests over £10,000

Should a debtor subsequently become so delinquent that legal action has to be taken or the debt written off, Sales Team Managers will be held accountable if they did not perform the procedures outlined above.

- Customers most likely to receive credit terms

- - Governments and their associated departments

- - Educational Institutions e.g. schools, colleges and universities

- - Multinational and reputable large companies e.g. Rio Tinto, Coca Cola

- Customers unlikely to receive credit terms

- - Resellers

- - Sole Traders / ‘One man/woman’ businesses

- - Small companies with little trading history

- - Companies that we have any reason to suspect of fraudulent or untrustworthy activity

- Before asking Accounts for credit terms employees should ensure that they have collected the following information from the customer:

- 1) Their legitimate website URL

- 2) The billing address provided by the customer should match one of the physical addresses shown on their website

- 3) A valid email address, which is from the company domain (i.e. no free mail addresses)

- 4) An official purchase order in PDF or Fax format with a company letter head

- Always use the provided Text Parts for any credit request and complete the required details in full:

- Customer number + company name:

- Amount + currency:

- Credit term (15 or 30 days):

- Complete address details:

- Please also remember:

- -The more days credit offered, the higher your profit margin should be.

- - If you are unsure about the credibility of your customer you may, offer 50% advance payment and 50% credit terms with a reasonable price level with the approval of your Sales Team Manager.

- - Enter the Purchase Order number if applicable (see NetSuite –> New Sales Order -> PO #).

- - Are there any special requirements for this order or terms? (e.g. Invoice to state different date or special shipment arrangements). All special requirements must be approved by your Sales Team Manager before the order is scheduled.

- - Has the customer agreed to the given credit terms in writing? There are too many amendments afterwards. The customer must provide written confirmation that they accept the payment terms.

- -Accounts are here to help, always ask them for help or clarification of any points if you are unsure

Sometimes when you are scheduling orders for customers who already have credit terms, you may find they are overdue or will surpass their credit limit. In these circumstances, Netsuite will automatically prevent you from scheduling the order. The customer will need to clear their overdue balance before you can schedule a new order. If this is problematic for your customer, please contact your Sales Team Manager.

Open and Overdue Invoices and Payment Chasing

Sales employees should regularly review their customers' outstanding payments and chase for payment.

To view all unpaid invoices, employees should use:

- My Sales Admin/ My Overdue Customers tab via Zimbra

To view all your unassigned commission where payment is do:

- Check commission assignment under Main Commission tab in Employee portal to see Unassigned commission and At risk commission (nearing 70 days overdue) tabs.

Unassigned commissions (customer not paid) shows the sum amount of orders where payment could be collected.

At risk commission (nearing 70 days overdue) shows the sum amount of orders that are between 60-70 days overdue.

When clicking on the amounts it will lead you to My overdue customers.

Payment chasing is very important:

- It helps to ensure that the customer receives their order on time

- When we go into pre-production we take on the financial risk for the order which exists until payment is received in full

- You receive your commission only when the order is paid in full

- Prompt customer payment helps Flashbay to maintain a healthy cash-flow

When to chase for payment:

- You should begin to chase payment from the first day that the customer is overdue

- We produce many orders overnight and they are ready for shipping the next day

- For Advance Payment customers payment chasing should begin on the same day after the order is scheduled

Formal procedure for chasing Advance Payment Invoices

1. Invoice is sent directly to Customer with the Sales Account Manager cc’d (sales order ‘Customer Contact’ field must always be populated correctly to ensure correct person receives invoice).

2. First payment follow up due 1 day after placing order. Communication objectives are to confirm that customer received invoice and to remind them that lead time is applicable from date payment/valid payment proof received. If customer’s real deadline is known, now is the time to advise/remind latest date payment can be processed for deadline to be honoured.

3. Second payment follow up due 3 days after placing order. Communication objectives are same as point 2. In addition customer should be solicited to advise expected payment processing date.

4. Further payment follow ups due 5, 7 and 9 days after placing order until payment/valid payment proof received. If customer commits to a payment date by phone, always write back confirming the same in your email memo.

5. If no payment/payment proof or payment commitment date received 10 days after placing order, customer is to be advised that order will be removed from our system if no payment/payment proof received within 1 week so that production parts can be reallocated to other orders.

6. If no payment/payment proof or payment commitment date received after the final week has elapsed, customer is to be advised that order has been removed from our system and a new order will need to be placed when they are ready to proceed, which may be at a different price considering the inexorable fluctuations of memory pricing. Cancellation request is then to be sent to After Sales along with evidence that steps 1-5 were followed.

7. During steps 1-5, customer is entitled to make a change to their order free of charge as long as we have not received payment/proof of payment.

A charge may apply if customer requests to make a change after payment/payment proof has been received. All change requests are to be sent to Aftersales who will revert with instructions.

Written confirmation:

Always get a written confirmation from your customer of any date given for when we

can expect receive payment. If payment confirmation is not received by this date then resume payment chasing.

Other possibilities if you cannot reach your customer:

- Be proactive and offer to call the customer’s accounts department directly

- Call the main reception and ask to speak to your customer contact or the person responsible for payment of invoices

- Include more email recipients on the email reminders that you are sending ( for example, CC the info@... or any other general accounts or contact email address that you are able to find on the customer website)

Customer relationship:

It is important to keep the relationship with your customer intact. You should make it clear to them

that your own accounts department is chasing you for payment proof, which is why you are chasing them.

Debt collection:

Once an invoice is 70 days overdue you need to forward full details of your case to your Team Leader and Accounts so that they can arrange for collection of the debt.

We accept the following as proof of payment:

- Official bank remittance advice or proof of Online Banking transfer in PDF, fax or paper format

- Screenshot of payment confirmation screen showing successful payment

- Credit/Debit card with our secure online payment facilities provided in the Customer Centre on our website (with the appropriate local surcharge for credit card payments).

- Please note that for reasons of data protection and security it is not acceptable to receive or internally communicate customer credit / debit card details by email.

Payment proof, action items:

1. When you receive a remittance please email paymentproof@flashbay.com

- Subject line: IN123456

- Hi All,

- Please approve to ship, remittance attached